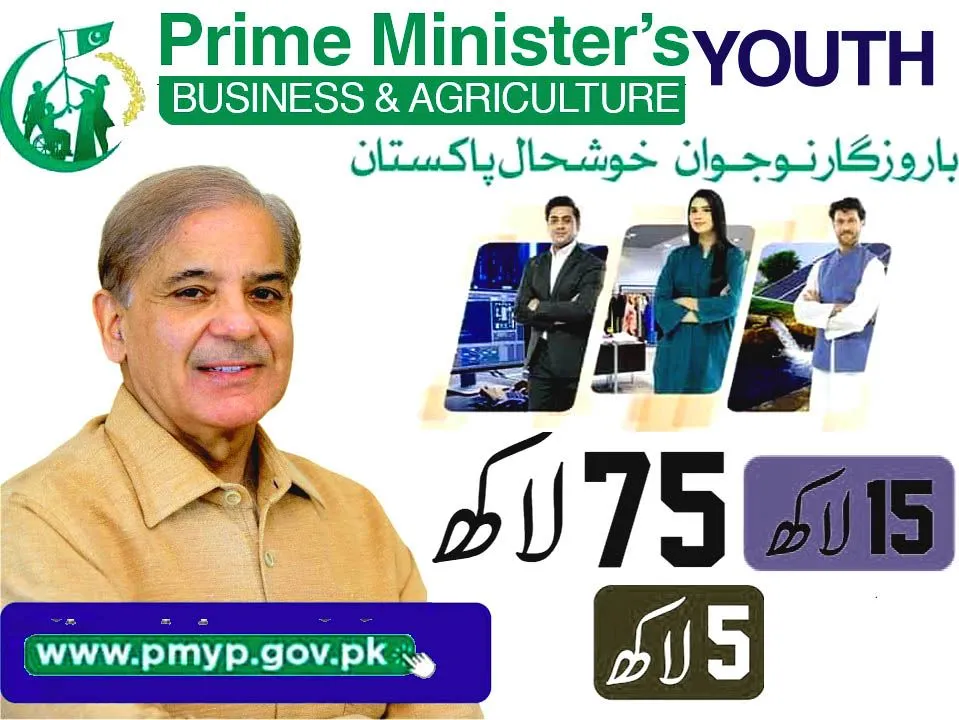

PM Youth Loan Scheme 2025

In 2025, the Government of Pakistan introduced another praiseworthy initiative aimed at uplifting its citizens, especially unemployed youth.

The Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYBALS) was introduced to offer financial support of up to PKR 7.5 million to those seeking to start or grow their businesses.

Let’s explore the specifics of this scheme, including who qualifies, how to apply, and the benefits you can gain from it.

What is the PM Youth Loan Scheme?

The Prime Minister’s Youth Loan Scheme is a government-backed initiative aimed at reducing unemployment and promoting entrepreneurship throughout Pakistan.It is accessible to both men and women from all regions, including “Azad Jammu & Kashmir along with Gilgit-Baltistan”

The loan can be repaid through convenient monthly installments over a period of eight years. Additionally, the first six months are completely interest-free, providing new ventures with a grace period to stabilize before commencing repayments.

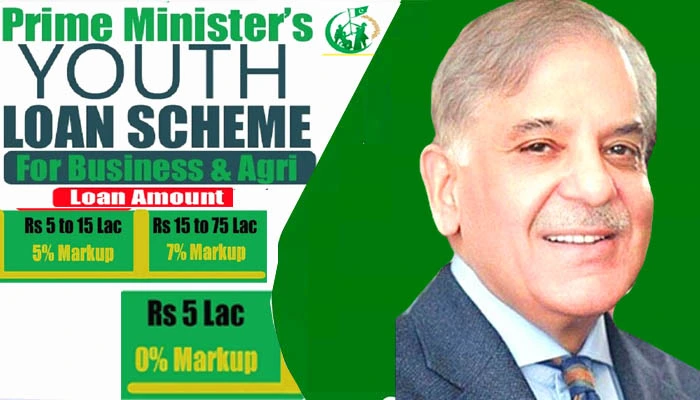

Loan Categories: Tier-Wise Structure

This program is organized into three distinct tiers, classified according to the amount of the loan offered:

Tier |

Loan Range |

Interest Rate |

|---|---|---|

Tier 1 |

Up to PKR 500,000 |

0% (Interest-Free) |

Tier 2 |

PKR 500,001 – PKR 1,500,000 |

5% Annual |

Tier 3 |

PKR 1,500,001 – PKR 7,500,000 |

7% Annual |

This article specifically highlights Tier 2 of the scheme, which allows applicants to request loans ranging from PKR 500,001 to PKR 1.5 million.

Main Highlights of the Scheme

- Loan Amount: As high as PKR 7.5 million, based on the chosen tier.

-

Repayment Term: Up to 8 years (96 months).

- Grace Period: No repayments needed for the initial 6 months

- Collateral Requirement: Subject to loan amount and the lending bank’s policies

- Application Process: Fully online, with no need for physical paperwork

Eligibility Criteria

✅ Who Can Apply:

- Pakistani citizens holding a valid CNIC

- Residents from any region within Pakistan

Individuals between the ages of 21 and 45 are eligible to apply, although the minimum age requirement is reduced to 18 for candidates in the IT or e-commerce fields

Those intending to launch a new business or grow an existing one

Readmore 7 Requirements Business Loans AKF Punjab Asaan Karobar Loan Scheme

❌ Who Cannot Apply:

Individuals employed in government service

Overseas Pakistanis who do not reside in the country

Banks Involved in the Scheme

The loans offered through this program are distributed by several leading banks, including:

Bank of Punjab (BOP)

- National Bank of Pakistan (NBP)

- Askari Bank

- Habib Bank Limited (HBL)

- Bank of Khyber

Among these, BOP, NBP, and Askari Bank are often preferred for their smoother application processes and quicker loan disbursements .

Application Process for the PM Youth Loan Scheme

- Step 1: Access the Official Portal

- Begin by visiting the official website: 👉 https://pmyp.gov.pk

Step 2: Utilize the Loan Calculator (Highly Recommended)

Before submitting your application, take advantage of the built-in loan calculator to estimate:

- Monthly repayment amount

- Total interest payable

- Overall repayment figure

💡 For example: Borrowing PKR 1,000,000 under Tier 2 for 8 years at a 5% interest rate would result in:

- Approximate monthly installment: PKR 12,660

- Total repayment (including interest): Approximately PKR 1,215,352

- No payments required during the first 6 months

Step 3: Begin Your Application

Click on the “Apply for Loan” button to begin the 9-step application procedure.

You will need to provide the following information:

- CNIC number and date of issuance

- Choose your loan tier (e.g., Tier 2 for PKR 500,001 – 1,500,000)

- Personal, business, and financial details

- Select a bank for processing your loan

- Upload necessary documents (e.g., business plan, CNIC image)

“Be sure to complete all fields marked with an asterisk (*) since they are mandatory.”

Important Tips Before Applying

✅ Ensure your CNIC is valid and current

✅ Prepare a simple business plan or outline

✅ Choose a trustworthy bank with excellent customer support

✅ Enter truthful and precise information throughout your application.

✅ Review all entries carefully before submitting

Tracking Your Application

Once you’ve submitted your application, you can monitor its progress by clicking on the ‘Track Application’ option on the PMYBALS Youth Loan Scheme homepage, using your CNIC and mobile number.

Conclusion

The PM Youth Loan Scheme 2025 presents an excellent opportunity for ambitious individuals with business ideas but limited financial resources. Offering an easy online application process, an interest-free grace period, and support from prominent banks in Pakistan, this initiative can significantly impact both individuals and communities.

Start your journey today-plan wisely, apply accurately, and confidently work towards building your future.

Frequently Asked Questions (FAQs)

Is collateral necessary?

Depending on the loan amount and the particular criteria of the bank, collateral might be required.

Are students eligible to apply?

Yes, students can apply as long as they meet the age and CNIC criteria and have a viable business idea.

Can someone with an existing business apply?

Yes, individuals who wish to expand their current business are also eligible for this scheme.

1 Comment

Hi